In 1992 Colorado voters passed the Taxpayer Bill of Rights, commonly referred to as TABOR, amending the state constitution (Article X. Section 20). TABOR has been in the news a lot lately because the state will be sending out refunds to taxpayers this year. If you want to learn more about the Taxpayer Bill of Rights, here are some resources that will give you a good start.

Tax laws and regulations can be complicated and difficult to understand. The Legislative Council Staff regularly publish “Issue Briefs” with short, easy-to-understand explanations on a wide variety of topics. Here is their explanation of TABOR:

TABOR restricts the authority of state and local government legislative bodies to make certain fiscal decisions. It requires state and local governments to obtain approval from voters in order to establish new taxes, raise tax rates, or issue multiyear bonded debt. It also prohibits certain types of taxes, including a state property tax, local income taxes, and the taxation of income at different tax rates.

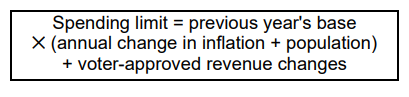

The TABOR amendment limits growth in the amount of government revenue that may be spent or saved. The allowable growth rate is equal to prior year inflation measured in the Denver-Aurora-Lakewood consumer price index plus the estimated prior year change in the state’s population.

“The TABOR Revenue Limit“, an issue brief from the Legislative Council Staff, breaks down the complexities of the Revenue Limit and explains how it is affected by other voter approved measures.

If revenue exceeds the state spending limit, the state is required to refund to money to taxpayers. For a breakdown of how the 2021 surplus will be refunded visit the TABOR Information site from the Colorado Division of Taxation.

This year the General Assembly passed Senate Bill 22-233 which requires the Colorado Department of Revenue to issue advance refund payments beginning in August 2022. Checks will be distributed beginning this month. More information about the refund checks can be found on the Colorado Cash Back web page.

For additional reading:

- History of Tabor Refund Mechanisms 2022

- Constitutional Spending Limit (2015)

- Report on Referendum C Revenue and Spending FY 2005-06 through FY 2021-22

- Taxpayer Bill of Rights Reports, Office of the State Controller

- Have you Registered to Vote? - September 17, 2024

- The Castlewood Canyon Flood of 1933 - August 3, 2023

- Holiday Selections - December 22, 2022